Purchasing a home can be intimidating, especially if it’s your first time. The choices you make when purchasing a home might either save you or cost you tens of thousands of pounds. There are so many other aspects you may not have even thought about like extra costs for surveys and fees, getting a mortgage and how much you can afford to pay as well as things you might be able to get like a stamp duty refund. Here are some of the other things you should know and consider when buying a house.

Is there moisture?

Look out for symptoms of dampness when you are viewing a house. Plaster that is flaking, a musty odour, and watermarks on the walls or ceilings are the most tell-tale indications of dampness. Although it may seem obvious, pay particular attention to the area near the ceiling and around the skirting boards. If the room has recently been painted, which may have covered any dampness, that could be another hint.

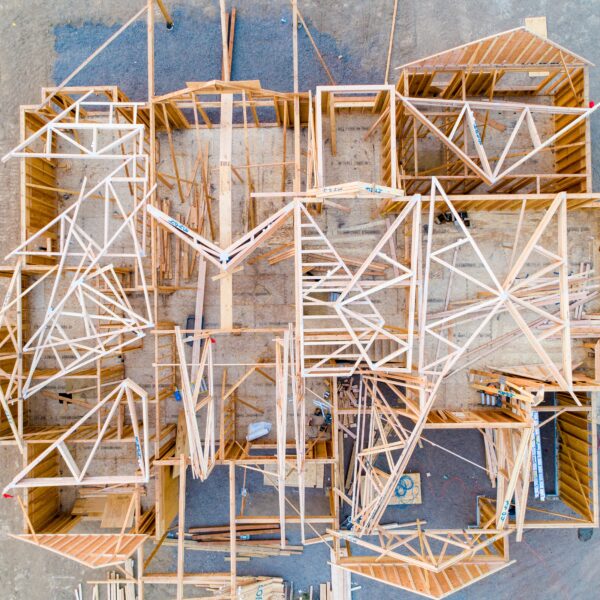

Quality

How pleasant a home is to live in depends on the quality of everything in it, from the materials used to create it to the finishing touches. A perfect home should be functional, beautiful, and efficient, with longevity and value for money playing an equal role in ensuring many lifetimes of use. The perfect house is one where you can make memories, and when making long-term plans, it’s crucial to think about the house’s quality so that it will last for many years.

Costly Home Improvements

To save money on the purchase price of a home, many buyers opt for fixer-uppers, believing they may later add to the property. Although many people are unaware of how significant home improvement may be, it is a good plan. The majority of us want to make all the fixes right away, yet we often underestimate how significant even the tiniest updates may be. Make sure there isn’t too much work to be done before purchasing a fixer-upper!

Select the ideal neighbourhood and kind of housing

Given your lifestyle and financial situation, weigh the benefits and drawbacks of various home styles. Although a condominium or townhouse may be less expensive than a single-family home, there will be less privacy because of shared walls with the neighbours. When looking at condos, townhomes, or homes in planned or gated communities, don’t forget to budget for homeowner association costs.

Discover your borrowing capacity

The amount of your deposit, your salary, and your credit score are just a few of the factors that will determine how much a mortgage provider will loan you. The lender will also consider the finances of any co-buyers if you are purchasing a property together. In general, banks will only let you borrow up to about four and a half times your yearly wage; however, this varies based on the specific lender, your financial situation, and the size of your down payment.

Buying a house can be very stressful but if you are organised and prepared then you can make it an enjoyable experience and prepare to enter a new chapter of your life as a homeowner.

Image Credits: RODNAE Productions

Like this article? Share with your friends!