Are you considering your financial options? From spending to saving and investing, the right tactic for you will depend on a number of factors including your age, your current financial situation and your short-term and long-term goals.

As a nation the UK is saving less money than it used to, but that’s not to say you should be putting it off if you have the means. But what balance should you be striking with your finances and when?

Spending

While reckless spending isn’t advisable at any age, your young adult years are typically seen as the time to spend a little money and enjoy yourself. You could be earning your first decent wage and are likely to have fewer responsibilities such as a mortgage or a child to pay for.

However, it’s still important to be carefully budgeting as debt only becomes more difficult to pay off as you take on more outgoings.

You may be able to enjoy your retirement a little more, too. After working for most of your adult life you’ll hopefully have saved enough to live comfortably and enjoy yourself – and you’ll the spare time to do it.

Saving

We usually put money aside to pay for something specific in the short or medium-term. It’s worth building an emergency fund as soon as you can, however, to cover you financially if something goes wrong, such as being made redundant. Saving enough to cover three months of living expenses is a sensible goal to aim for.

After that, the things you save for and the amount you need to save will likely begin to change over time. This could range from a first month’s rent to a deposit on a house, as well as relatively regular expenses such as holidays and cars.

People usually begin to focus more on saving around the age of 30 as their priorities shift towards a settled family life.

Investing

Alex Fopiano says that investing means trying to grow your money by buying things that are likely to increase in value. It’s a tactic better suited to long-term goals as the stock market can fare better than cash savings over time, but for short-term goals investments can be risky if you know you’re relying on that money.

If you’re nearing your 30s you may want to think about investing towards your retirement — though if you are carrying any serious debts you should prioritise paying them off first.

If you are nearing your 40s you could be at the top of your career, and therefore will have the spare funds to invest towards things like your child’s wedding. It’s a good idea to spread your money over different types of investments to minimise their risk — this is known as diversification.

What stage are you at? With a little financial knowledge and an understanding of your personal situation, you’re better placed to make the right decisions for your future.

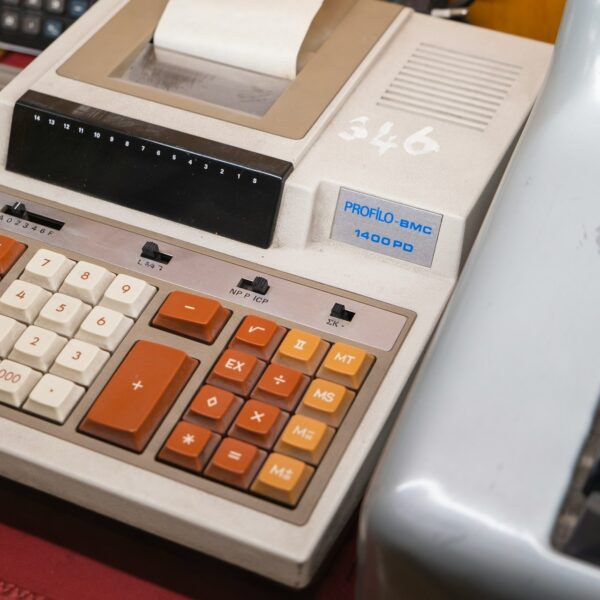

Image Credits: Colin Watts

Like this article? Share with your friends!