Despite a raging coronavirus pandemic, Brazil managed to produce an average of 2.94 million barrels of oil per day (Mb/d) in 2020. This was 5.5 percent higher than their 2019 output of 2.785 Mb/d, and surpassed that of OPEC’s third largest oil producer, the United Arab Emirates at 2.77 Mb/d.

Brazil is now the seventh largest crude oil producer in the world, and the largest in Latin America. Surpassing both Venezuela and Mexico, the reasons for the increase in oil production in Brazil are numerous. New offshore oil deposits have been discovered, and multinational oil companies as well as the government-owned company Petrobras are actively setting up new refineries. International investment is encouraged while Petrobras continues to divest and sell some of its refining assets.

Petrobras and Multinationals Find New Reserves

Petrobras was established in 1953 by President Getúlio Vargas. After World War II ended, there was a significant rise in global demand for oil and several other Latin American countries had already started their own state oil companies. Petrobras was able to maintain a monopoly for the next 40 years, as the Brazilian constitution forbade foreign oil companies from investing in oil exploration and production.

This monopoly ended in 1997 when President Fernando Henrique Cardoso convinced Congress that since the country still needed to import oil, opening up to foreign investment would enable Brazil to become self-sufficient. Since that time, multinational companies have brought in large amounts of foreign capital and all the latest technology to find and extract new oil reserves.

In 2006 Petrobras announced the discovery of a giant oil deposit off the coast of Brazil, deep beneath a layer of salt in the Atlantic Ocean known as a “Pre-salt” field. It is estimated to hold 50 to 100 billion barrels of recoverable crude oil valued at over $2.5 trillion. These include the Pre-salt fields of Tupi, Búzios, and Sapinhoá in the Santos Basin and others in the Campos Basin, located south of Rio de Janeiro in the South Atlantic. (See map) Petrobras as well as multinational oil companies such as Shell, BP, Chevron and ExxonMobil are spending hundreds of millions of dollars to develop these reserves and extract the oil.

Map from ResearchGate. Map showing onshore and offshore Brazilian Basins for natural gas and oil reserves in the Santos and Campos Basin used for pre-salt oil extractions.

Petrobras Divests to Attract New Investors

Petrobras has implemented a large divestment plan that should make room for other international oil companies (IOCs) to operate in the Pre-salt regions. Since 2016 private oil companies have been allowed to participate in license bidding, although Petrobras still has the right of first refusal and a share of 30 percent or more. Brazil also reduced requirements to use locally produced goods and services that had led to delays, and returned to a regular schedule of annual licensing sales. However, some international oil companies decided not to participate due to high signing bonuses required and complicated contracts.

Petrobras is looking to sell eight of its refineries by the first half of 2022, and is shedding more than 100 onshore and offshore fields, according to S&P Global Platts. This should create an increase in market share for small- and medium-sized companies as well as the large multinationals.

Alessandro Bacci, Oil and Gas Analyst at GlobalData, believes that “Increasing the number of operators will create a more economically resilient Pre-Salt oil and gas sector because it wouldn’t be linked to the financial performance of just one company, which in case of financial difficulties could be forced to postpone projects. The financial position of Petrobras has opened up additional opportunities, and there is an interesting alignment between the Agência Nacional do Petróleo’s (ANP) and the IOCs’ goals.”

Brazil needs to increase the pace of allowing more companies to invest in oil production. It faces new competition from other Latin American countries such as Guyana and Uruguay who plan to offer licensing sales in 2021. For example, ExxonMobil recently made 18 discoveries in the Stabroek block in Guyana. Also, the worldwide transition to renewable energy projects will increase the competition for investments in oil exploration and production.

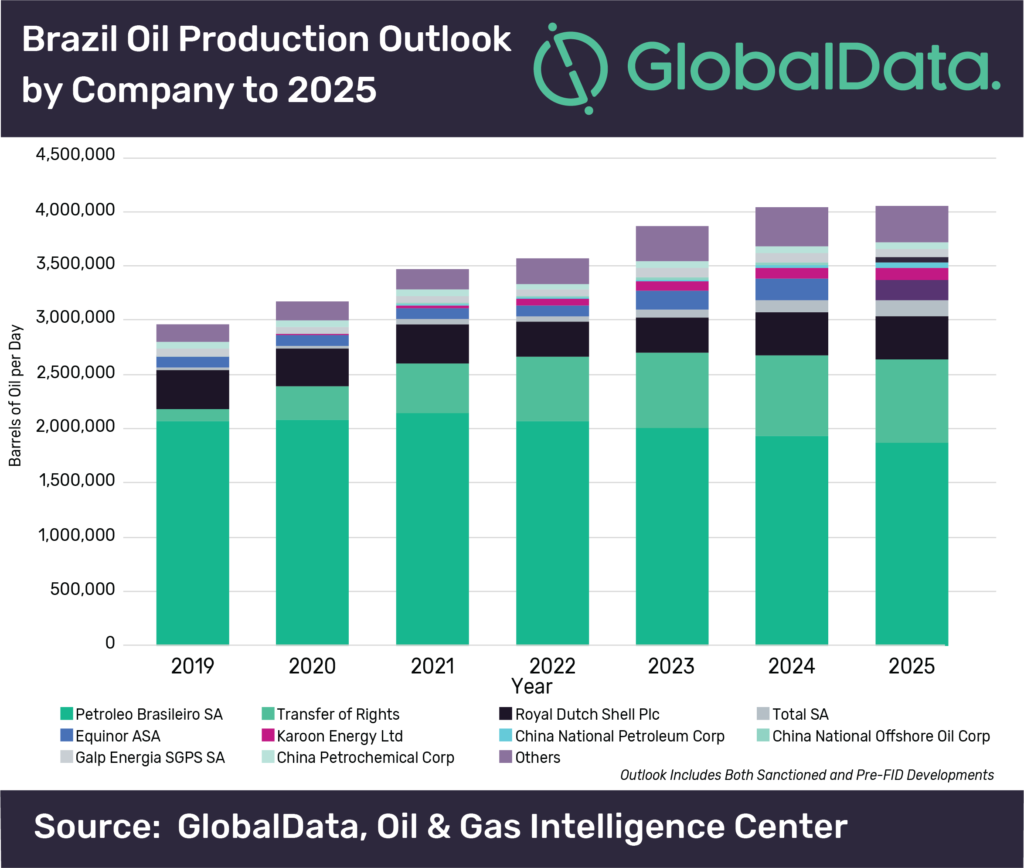

However, the current forecasts for oil production in Brazil are indeed very bright. GlobalData projects that Brazil will reach 4 Mb/d by 2025, while Brazil’s energy research agency EPE expects crude output to hit 5.2 Mb/d in 2026. That could make Brazil the fourth-largest producer in the world, behind the United States, Saudi Arabia and Russia.

Image Credits: gabyartaza, ResearchGate, GlobalData

Like this article? Share with your friends!